What Is The Requirement To Register A Business In Misouri

How to Start a Business organisation in Missouri:

In 2014, Missouri became the number one state for business banking. The state continues to enjoy consistent employment growth in the financial sector. Low operating costs, high returns on investment, revenue enhancement credit programs, and an affluence of grants and loans for pocket-sized business all make Missouri a desirable place to start a business organization.

one.1

Review Missouri germination options.

Missouri offers iv means of forming your business organisation. Review these closely and selection the i that fits your business organization best.

When starting a modest concern in Missouri, the legal entity yous choose will take an bear on on your taxes, paperwork, personal liability, and your ability to raise funds for your concern.

Before you can name your business, you'll take to determine the availability of your preferred proper name.

Get to the Missouri Secretary of State website.

Select "Search" in the bill of fare tab.

Ensure that you lot filter the results by business organisation proper name. This should exist the default choice.

Enter your proposed name in the search box.

Read through the search results, which volition include identical and/or like names.

Click "Open up" to read more most each registered business.

Perform a Google search to find out if anyone is currently using the name and whether the domain name is available.

ane.3

Go an Employer Identification Number (EIN).

Well-nigh all businesses volition need to annals for federal taxes by applying for an Employer Identification Number. The fastest and easiest way to get your EIN is to fill out and submit an online application on the IRS website, and yous'll receive your EIN via email inside 24 hours. This service is gratuitous of charge.

The application must be finished in 1 session. Y'all will not be allowed to save or render.

1.4

Register your business concern in Missouri.

Once you have chosen a business proper name and a legal structure, yous can annals your business organisation with the state.

Visit the Missouri Secretarial assistant of State website and download the Registration of Fictitious Name form. You tin do this past clicking on the file titled "Creation, Renewal, Correction and Amendment of Fictitious Proper noun (Corp. 56)."

Complete the awarding form and submit it. The filing fee is $7.

A fictitious proper name registration lasts five years and may be renewed thereafter. Business organisation owners have six months prior to the expiration engagement in which to renew their fictitious name.

Depending on your business organisation structure, yous may need to file articles of incorporation, manufactures of organization, or another formation certificate.

1.v

Obtain necessary permits and licenses.

Missouri businesses require licenses from the state. Depending on your blazon of business, y'all may need to obtain specific licenses or permits from your local city or county clerk'southward office. Keep in mind that certain professions may require special licenses or certifications. For a listing of Missouri cities, municipalities, and counties, visit www.mo.gov.

- Register with the Missouri Department of Agriculture for agricultural licenses and permits.

- Register with the Missouri Department of Natural Resource for environmental permits or certification.

- Find permits and licenses specific to your industry.

ii.

Register your business for taxes.

ii.1

Apply for a land taxation ID number.

Many business organisation practices are subject to federal and country income taxes, which ways you lot may demand to register your business organisation with the Missouri Section of Revenue. This tin be washed online.

Afterwards you have completed your online registration, you lot may receive a confirmation number and additional information about your registration. Let two to three business days for processing.

Go to the Missouri Section of Revenue website.

Scroll to the bottom of the folio and click "Get-go Registration Hither."

Agree to the terms and atmospheric condition and click "Side by side."

Fill in the relevant data and follow the prompts to annals your business.

2.2

Register for sales tax.

If you are a business in Missouri and you partake in the sale of tangible goods, you are required to register for a sales revenue enhancement permit. You lot meet the criteria for sales revenue enhancement registration if y'all have an role in the country, have employees present in the country, store appurtenances in a Missouri warehouse, deliver goods in a Missouri licensed vehicle, or have independent contractors in Missouri.

Log in with your details and follow the prompts to register for a sales revenue enhancement permit.

You will need to upload documents containing your personal and concern identification information, estimated monthly sales to buyers in Missouri, and more.

You will receive your Missouri sales taxation license number in 5–viii days.

ii.3

Register for consumer'due south use tax.

You are required to register for consumer's utilise tax in Missouri if you brand a purchase from a seller outside of Missouri and do non pay Missouri apply tax, or if y'all make a purchase from a seller that is not engaged in business.

Log in with your details and follow the prompts to register for consumer's utilize taxation.

ii.4

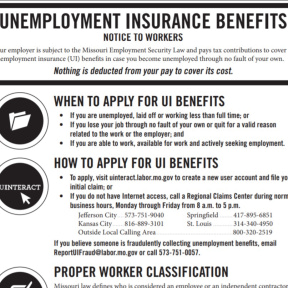

Register for unemployment insurance tax.

You lot will demand to annals for Missouri unemployment insurance tax with the Missouri Department of Labor & Industrial Relations.

Go to the Missouri Department of Labor & Industrial Relations website.

Click on the "Employers" tab.

Roll downwardly and select the "New Unemployment Tax Account" pick.

Your business should already be registered with the Missouri Section of Revenue, so select "Yes."

Log in to the Missouri Online Unemployment Organization and follow the prompts.

two.5

Annals for withholding tax.

Withholding tax is the proportion of a worker's salary paid past an employer that is owed to the federal government. Missouri businesses that employ staff are required to register for withholding tax.

Log in with your details and follow the prompts to register for withholding taxation.

3.

Hire employees and report them to the state.

3.2

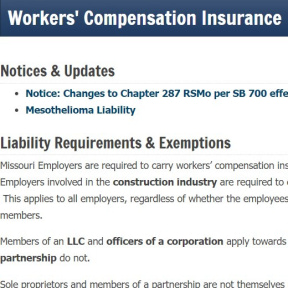

Obtain workers' bounty insurance.

All employers in Missouri who have five or more employees are required to acquit workers' compensation insurance, regardless if they are role-time or temporary workers. If you are in the construction industry, this number reverts to one or more employees. For more information, refer to the Department of Labor's website.

3.3

Display mandatory posters in your place of business.

The Missouri Department of Labor and Industrial Relations mandates that all employers display the following posters for the benefit of employees and customers:

- Notice to Workers Apropos Unemployment Benefits (MODES-B-2).

- Workers' Compensation Law (WC-106).

- Discrimination in Employment (MCHR-9).

- Missouri Minimum Wage Law (LS-52).

- Employer's Employing Workers Under the Age of 16 List (LS-43).

- Discrimination in Housing (MCHR-6).

- Discrimination in Public Accommodations (MCHR-7).

Go to the Missouri Department of Labor & Industrial Relations website.

Select the "Download mandatory posters" selection at the bottom of the page.

Read through the list of posters required by the country and the federal government.

Click on each one to download a affiche in PDF form.

Missouri Business organisation Types:

1. Sole proprietorship.

Sole proprietorships are the simplest way to start a business in Missouri. Sole proprietorships offering ease of formation and consummate ownership. Just course a sole proprietorship when you lot know all the risks associated with your business organisation, as you lot will be personally liable for business losses.

Your primary decision equally a sole proprietor is to determine whether yous will utilise your real name or create a fictitious business organization name. Y'all simply need to register with the Secretary of State if you'll exist using a fictitious name. Registered sole proprietors are still required to obtain a sales tax and use permit and an EIN.

Sole proprietors are taxed on their income tax returns based on individual tax brackets, and they are not required to file for withholding tax or social security revenue enhancement if they don't use anyone.

2. Partnership.

Forming a general partnership in Missouri is piece of cake. Partnerships are ideal if your business partner can bring upper-case letter and expertise to the table that you lot cannot. The profits and risks are shared every bit among partners and yous don't pay business organization tax.

Dissimilar registration rules use to each kind of partnership in Missouri. General partnerships merely have to register with the state if they are operating nether a fictitious name. Limited partnerships are required to file a Certificate of Limited Partnership with the state.

Limited liability partnerships must file an Application for Registration of an LLP. Missouri also offers limited liability limited partnerships, which are required to file a Certificate of Limited Partnership.

When it comes to tax, the rules of partnerships are like to sole proprietors. Partnerships in Missouri do not have to file whatsoever tax returns because their business organization income and personal income are inseparable.

3. Corporation.

Registering as a corporation in Missouri is more costly and takes longer, but the benefits are clear. A corporation will allow you lot to dip into a wider capital pool and protect your personal assets in the event of a business failure. Corporations need to pay business taxation.

Registering every bit a corporation begins with filing articles of incorporation with the Corporations Sectionalisation. This includes providing your business name, as well as the details of your registered agent, registered office, share authorization, Missouri incorporator, duration, purpose, directors, and constructive date. You will also need to file Annual Registration Reports with the Missouri Corporations Division.

4. Limited Liability Company (LLC).

Contain equally an LLC in Missouri if you operate in a loftier-gamble industry and desire more ability over the operational activity of your company. LLCs afford meliorate profit distribution among members besides as few ownership restrictions.

Registering equally an LLC in Missouri is very like to registering as a corporation. Missouri requires all registered LLCs to adopt a written operating agreement. Missouri law also requires all registered LLCs to include the words "Limited Liability Company" in its total or abbreviated forms if registering equally this type of entity.

What Is The Requirement To Register A Business In Misouri,

Source: https://www.namesnack.com/guides/how-to-start-a-business-in-missouri

Posted by: wollthrogerfuns.blogspot.com

0 Response to "What Is The Requirement To Register A Business In Misouri"

Post a Comment